Cash in the bank is necessary for a business to keep paying the bills and stay in business. Many factors can contribute to cash flow problems including:

- a lack of profit,

- seasonal changes in sales,

- growth,

- increases in accounts receivable, and

- start-up expenses.

Careful planning, projections, and decision making are necessary to prevent business failure. Being super rich can also help prevent cash flow problems, but doesn’t mean they can’t occur. For example, if substantial assets are tied up in real estate or other long term investments, even those with a high net worth can run out of cash.

The Cash Flow Projection is very similar to an Income Statement except it is adjusted to include only cash transactions. The cash flow projection starts with the beginning cash balance. The time period is usually monthly. Cash sales, other revenue, and receivables collected are added. Cash expenses and cash payments on accounts are subtracted. Loan payments including interest and principal are subtracted. Owner draws are subtracted. Owner investments, loan proceeds, and line-of-credit advances may be added. Capital expenditures are subtracted. The result is ending cash. This will be the starting cash for the next period.

If ending cash is projected to be negative, explore the possible options. These might include the owners putting in more cash, a temporary line-of-credit, start-up funds borrowed, possible vendor credit, increased receivables collected, inventory reductions, sale of capital assets, or reduced owner draws.

No one can see into the future. Being in business is risky. Better predictions are based on better information. Predict good things happening. Then, predict bad things happening. Weigh the good prospects against the bad. Explore the options for the business if each happens. The more known about the business, the more likely good predictions and decisions will be made. These projections should be reviewed and updated on a regular basis. If the business is new, has made recent changes, has tight cash balances, or is seasonal, these reviews should be at least monthly.

Business owners are often optimistic about growth and see where increased expenditures will increase efficiency. An example would be increasing inventory to increase sales, reduce special orders, and the extra time they take. Unfortunately, increasing inventory usually takes cash or credit. Careful projections need to be made to calculate whether or when the business will have enough cash flow to safely increase inventory. Then evaluate whether or not this is the best use of the cash.

Vehicle purchases are another temptation, sometimes related to reducing income tax liabilities. A detailed long term cash flow projection can be helpful as well as an evaluation of associated questions. How much and when will the purchase reduce tax liabilities? Will cash flow be adequate to cover the loan payments? Does the new vehicle increase sales or reduce expenses? Will this the best use of cash at this time?

Cash flow projections can be made on a paper spreadsheet, with QuickBooks, or with other software. You can download a free SCORE Financial Projection Template to Excel.

Visit the following for additional information on Accounting Basics.

SBDC consultants are available to help small businesses develop and analyze cash flow projections. No-cost consulting is available by appointment in each region in Idaho. Click the Request an Appointment button below to schedule a confidential meeting.

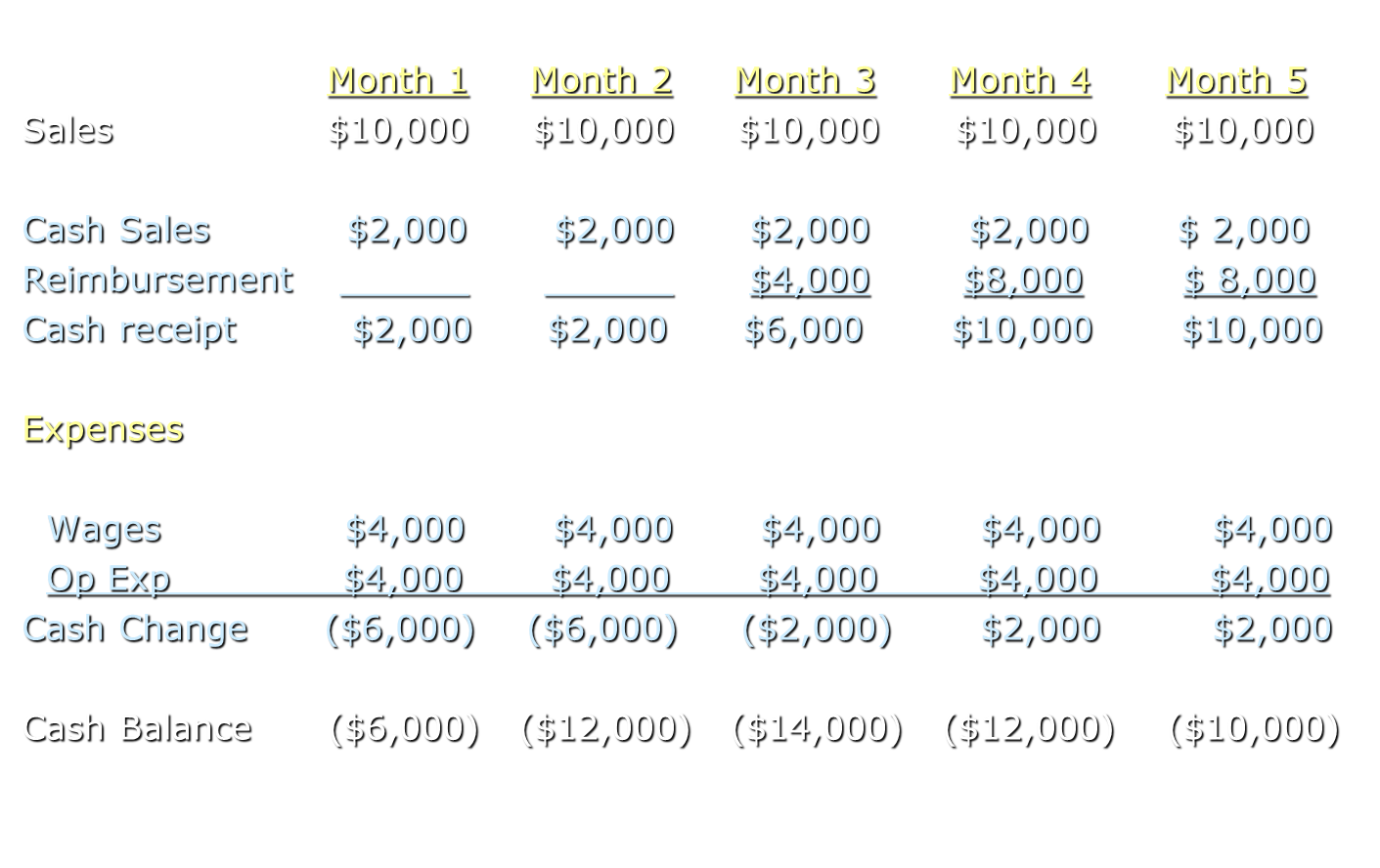

Example Cash Flow Projection:

A Family Practitioner opens a practice and sees 100 patients per month. The average bill is $100 per patient. Expenses are: operating $4,000 per month and wages are $4,000 per month. Payments are: 20% of patients pay with Cash/Credit Card, 40% of patients are Medicare with payment in 60 days, and 40% of patients are Medicaid with payment in 90 days.

The above projection shows the doctor will need additional cash or a line of credit to cover the estimated shortage in the cash balance of $14,000.